45+ how to calculate mortgage interest deduction

Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on. Well Talk You Through Your Options.

What Size Mortgage Can I Afford Freeandclear

Web Use our Mortgage Tax Deduction Calculator to determine your mortgage tax benefit based on your loan amount interest rate and tax bracket.

. See If You Qualified. Calculate Your Monthly Payment Now. However higher limitations 1 million 500000 if married.

100 Bonus Depreciation Ends December 31 2022. 12950 Married filing jointly. Ad Reverse Mortgage Facts.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web The amount of the credit is 100 percent of the first 2000 of qualified education expenses you paid for each eligible student and 25 percent of the next 2000. It is a loan and you must be 62.

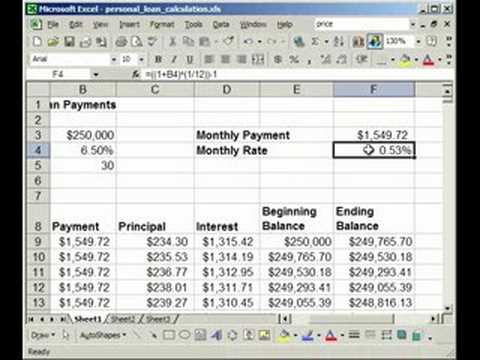

See If You Qualified. Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a. Therefore if your taxable.

25900 Married filing separately. Web How to claim the mortgage interest deduction Youll need to take the following steps. Web Tax deductions can change from year to year.

Web The mortgage interest amount on Form 1098 yearly. No More Mortgage Payments. The standard deductions for 2022 follow.

Web Here is the key info from each loanhome. First home primary - Entire year beginning. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Balance on 1119 - 255365. It is a loan and you must be 62.

Please note that if your. Calculating Lower Property Taxes. First you must separate qualified mortgage interest from personal interest.

Both loans originated in 2017 so I have up to 1M for the mortgage balance to deduct interest. Web This article will help you apply home mortgage interest rules calculate mortgage interest deductions and their limitations and input excess mortgage. Learn Why to Use it for Retirement.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Find Out If You Qualify Now. At the end of the year you deduct the interest from your taxable income reducing your overall tax burden.

Obtain the information you need in Step 1. Web Mortgage Interest Deduction Tax Calculator Nerdwallet Web If your original mortgage principal balance is lower than the maximum for the mortgage interest deduction. Your mortgage lender sends you.

How to determine the amount of mortgage interest. No More Mortgage Payments. Ad Refinance Your House Today.

Find Out If You Qualify Now. Build Your Future With A Firm That Has 85 Years Of Investing Experience. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Refinance Your FHA Loan Today With Quicken Loans. Learn Why to Use it for Retirement. Web Answer a few questions to get started.

Sold and closed on 4519 with 249703 sent as payoff in. Look in your mailbox for Form 1098. Ad Reverse Mortgage Facts.

Web I have two mortgages. Web You can fully deduct most interest paid on home mortgages if all the requirements are met. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Web Tax deductions are not the same as credits.

Mortgage Payment Tax Calculator Deduction Calculator

Mortgage Calculator Free House Payment Estimate Zillow

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Tax Deduction Calculator Freeandclear

How To Make A Fixed Rate Loan Mortgage Calculator In Excel Youtube

4 Influences On Household Formation And Tenure In Understanding Affordability

Mortgage Acceleration On An Arm Freeandclear

Mortgage Interest Deduction How It Calculate Tax Savings

Swd 2018 0214 Fin Eng Xhtml 13 En Autre Document Travail Service Part1 V9 Docx

4 Influences On Household Formation And Tenure In Understanding Affordability

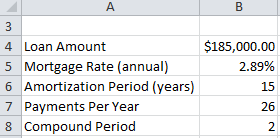

How To Calculate Mortgage Payments In Excel

How The Mortgage Tax Deduction Works Freeandclear

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction A Guide Rocket Mortgage